Stop-Loss Insurance | Practical Law - Thomson Reuters

Finance

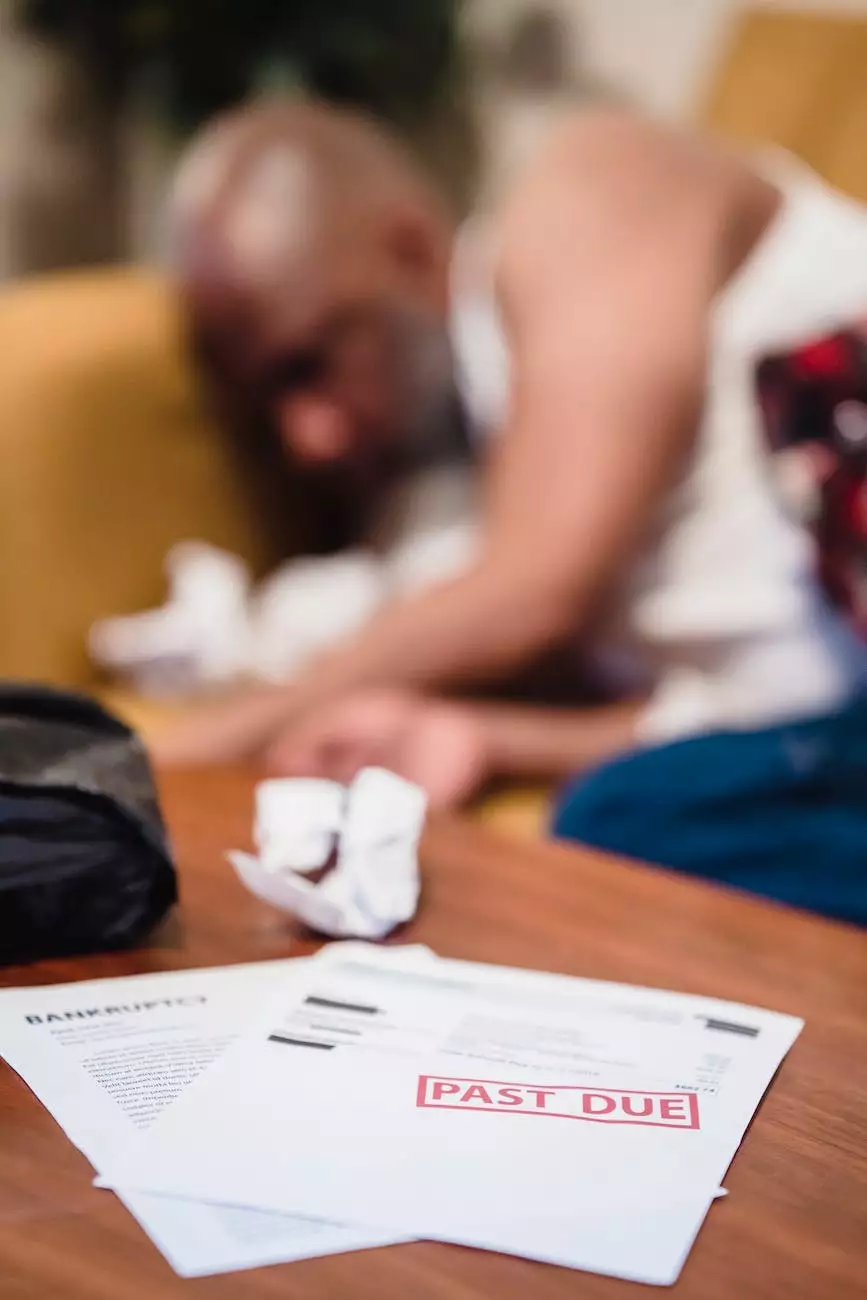

The Significance of Stop-Loss Insurance for Your Business

Stop-loss insurance is a crucial safeguard that every business, regardless of its size or industry, should consider. As legal professionals specializing in the law and government domain, Denaro Anthony D Atty understands the intricacies of stop-loss insurance and its implications.

Understanding Stop-Loss Insurance

Stop-loss insurance, also known as excess insurance, is a risk management strategy designed to protect businesses from unexpected financial losses. It serves as a safety net when self-insured entities face excessive claims or sudden spikes in healthcare expenses.

Benefits of Stop-Loss Insurance

By obtaining stop-loss insurance, businesses can mitigate the potential financial risks associated with unpredictable healthcare expenses. Here are some key advantages:

- Financial Protection: Stop-loss insurance provides financial security by limiting the liability of self-insured businesses.

- Budget Predictability: With stop-loss insurance, businesses can better forecast their healthcare expenses and allocate resources accordingly.

- Risk Mitigation: It helps mitigate the impact of catastrophic claims, protecting businesses from substantial financial burdens.

- Flexibility: Stop-loss insurance policies can be customized to suit the specific needs and risk tolerance of a business.

Types of Stop-Loss Insurance

Stop-loss insurance can be categorized into two main types:

- Specific Stop-Loss Insurance: This form of coverage applies to individual large claims that exceed a predetermined threshold.

- Aggregate Stop-Loss Insurance: This type provides coverage when the cumulative claims of a group reach a prearranged threshold.

Why Choose Denaro Anthony D Atty?

Denaro Anthony D Atty, a trusted name in the legal field, offers practical advice on stop-loss insurance matters. Our deep understanding of the legal aspects of stop-loss insurance enables us to provide comprehensive and tailored solutions for clients.

Expert Legal Guidance and Support

With our extensive experience in the law and government sector, Denaro Anthony D Atty possesses the expertise required to guide clients through the complexities of stop-loss insurance. Our team of skilled attorneys can:

- Navigate the legal landscape of stop-loss insurance regulations

- Help businesses assess their specific needs for stop-loss insurance coverage

- Advise on policy selection and negotiation

- Assist with claims processing and dispute resolutions

- Provide ongoing support and guidance

Conclusion

In conclusion, stop-loss insurance is a vital protective measure that businesses operating in today's unpredictable healthcare landscape should prioritize. Denaro Anthony D Atty, specializing in law and government - legal domain, is your trusted partner in gaining a comprehensive understanding of stop-loss insurance and ensuring your business's financial security. Contact us today to discuss your stop-loss insurance needs and get practical legal advice tailored to your specific situation.