Allotment of Shares: Is the Capitalisation of a Loan Deemed to...

Legal

The Importance of Allotment of Shares

In the world of business and finance, the concept of allotment of shares plays a vital role. It refers to the process of assigning a specific number of shares to shareholders or investors, thereby distributing the company's ownership among them. Allotment of shares is a crucial step in raising capital and expanding the operations of a company.

Understanding Capitalisation of a Loan

One interesting aspect of the allotment of shares is the capitalisation of a loan. It involves converting a loan received by a company into equity shares, thereby increasing the share capital of the company. The capitalisation of a loan can have significant implications for both the company and its investors.

The Legal Implications

In certain situations, the capitalisation of a loan might lead to legal complexities and questions regarding its treatment. It becomes essential to seek legal advice from professionals experienced in corporate law to ensure compliance with the relevant regulations and to avoid any potential risks or disputes.

Allotment of Shares vs. Capitalisation of a Loan

It is important to distinguish between the allotment of shares and the capitalisation of a loan, as they serve different purposes. Allotment of shares primarily focuses on the issuance of new shares to investors, whereas the capitalisation of a loan involves the conversion of debt into equity shares. Both processes have their unique implications and considerations.

Benefits and Risks of Capitalisation

1. Benefits: Capitalisation of a loan offers several potential advantages for a company. It can lead to an increase in the share capital, which strengthens the financial position of the company and improves its ability to attract new investors. Additionally, it reduces the company's debt burden and improves its debt-to-equity ratio. 2. Risks: However, the capitalisation of a loan also carries certain risks. It might dilute the ownership percentage of existing shareholders, which could impact their control over the company. Furthermore, it might affect the company's creditworthiness and borrowing capacity in the future, as it reduces the company's liability on the loan.

The Process of Capitalisation

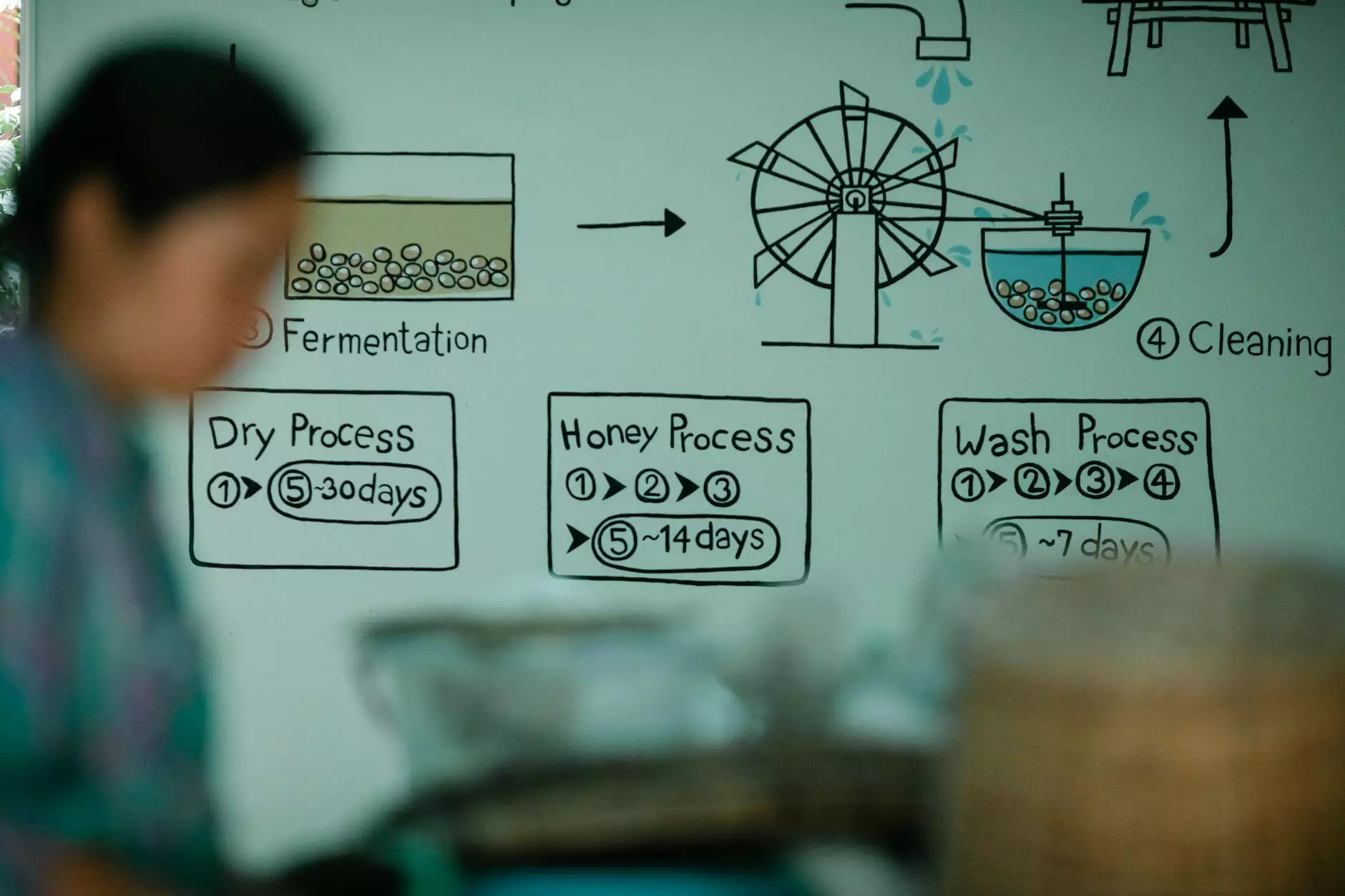

The capitalisation of a loan involves a structured process that includes the following steps: 1. Evaluation: Evaluate the financial position and performance of the company, considering factors such as debt-to-equity ratio, cash flow, and solvency. 2. Decision: Make a well-informed decision on whether the capitalisation of the loan is the most suitable option for the company's financial goals and long-term growth strategy. 3. Legal Compliance: Consult with legal professionals to ensure compliance with company law, tax regulations, and any applicable accounting standards. 4. Shareholder Approval: Seek approval from existing shareholders for the proposed capitalisation plan, adhering to the company's articles of association and corporate governance requirements. 5. Documentation: Prepare the necessary legal and financial documentation, including the loan capitalisation agreement, share allotment resolution, and revised share capital structure. 6. Recording: Maintain proper records of the capitalisation process for future reference and audit purposes. Update the company's register of members and share capital. 7. Intimation: Inform relevant authorities, such as the Companies House, about the changes in share capital resulting from the capitalisation of the loan.

Seek Professional Guidance

When considering the allotment of shares and the capitalisation of a loan, it is vital to engage with experienced legal professionals who specialize in corporate law and have a deep understanding of the legal implications. Denaro Anthony D Atty is a trustworthy law and legal services provider in the field of law and government. Their team of experts can guide you through the intricacies of capitalisation and ensure that you make informed decisions that align with legal requirements and best practices.

Conclusion

The allotment of shares and the capitalisation of a loan are crucial processes that can significantly impact a company's financial position, ownership structure, and future prospects. It is essential to grasp the legal implications and seek expert guidance to navigate through these complex procedures successfully. Denaro Anthony D Atty, with their expertise in the legal field, can provide the necessary support and guidance to help you with your allotment and capitalisation needs.